How is Solana front-running Ethereum this cycle? Meanwhile, Bitcoiners are busy building sidechains and Cardano on BTC.

Solana Protocol Analysis

Key Takeaways:

1. Advanced Protocol Mechanics: Solana leverages a unique combination of technologies, including Proof of History (PoH), Tower BFT, Turbine, Gulf Stream, Sealevel, Pipeline, Cloudbreak, and Archivers, to deliver unparalleled performance and scalability.

2. Growth Catalysts: Solana's growth is propelled by robust user adoption and an expanding dApp ecosystem, supported by over 1 million daily active addresses and a high volume of daily transactions. Strategic partnerships with major firms like Stripe, Visa, and Google Cloud, enhance its utility and foster mainstream adoption.

3. Associated Risks: Despite its advancements, Solana faces significant challenges, including network stability concerns highlighted by several significant outages and ongoing security risks due to limited client diversity.

4. Token Design and Economics: The SOL token is central to transaction processing and network security, with a deflationary model designed to incentivize participation and maintain network health.

5. Future Outlook: In the next 1-2 years, Solana aims to significantly expand its market presence, with projections suggesting a potential increase in market cap to approximately $175 billion, guided by historical market trends.

SOLANA

Solana stands at the cutting edge of blockchain technology, renowned for its speed and scalability. This article explores the key technologies powering Solana, highlights its rapid ecosystem growth, discusses inherent risks, and evaluates its economic strategies. Solana's future prospects, driven by continuous technical enhancements and strategic partnerships, position it as a formidable player in the web3 landscape.

1. Understanding the Protocol Mechanics

Solana achieves unparalleled performance and scalability through its bespoke array of innovative technologies.

Now, let look at the components that make this happen in detail (alternate explanation is here):

1.1 Proof of History (PoH)

Solana's consensus mechanism is underpinned by Proof of History (PoH), a cryptographic technique that provides a verifiable time source. PoH generates a sequence of time-stamped events through a high-frequency Verifiable Delay Function (VDF). This sequence ensures real-time passage between steps and uses a pre-image resistant hash function (e.g., SHA256) to maintain integrity. By eliminating the need for nodes to communicate to agree on transaction order, PoH reduces latency and significantly increases throughput.

1.2 Tower BFT Consensus

Building on PoH, Solana's Tower BFT is Solana’s consensus algorithm. Tower BFT leverages PoH as a network clock to reduce messaging overhead and latency, facilitating rapid and consistent transaction validation.

1.3 Turbine Block Propagation

Inspired by BitTorrent, Turbine optimizes data propagation by using a tree structure to distribute data efficiently, reducing the bandwidth needed for block transmission.

1.4 Gulf Stream - Mempool-less Transaction Forwarding

Gulf Stream enhances transaction efficiency by pushing transaction caching and forwarding to the network's edge. Validators forward transactions to upcoming leaders, enabling pre-execution and reducing confirmation times.

1.5 Sealevel Virtual Machine (SVM)

Sealevel leverages LLVM to optimize and execute BPF (Berkeley Packet Filter) programs efficiently on Solana, facilitating parallel transaction processing.

1.6 Pipeline

Solana’s Four-Stage Transaction Processing Unit (TPU) Pipeline:

Data Fetching: Fetches data at the kernel level.

Signature Verification: Verifies signatures at the GPU (Graphics Processing Unit) level.

Banking: Processes transactions at the CPU level.

Writing: Writes transactions to disk at the kernel level.

By the time the TPU sends blocks to validators, it has already fetched, verified, and processed the next set of transactions. Validators run two processes: the TPU for creating ledger entries and the Transaction Validation Unit (TVU) for validating entries.

1.7 Cloudbreak: Horizontally Scaled State Architecture

Cloudbreak organizes the accounts database to allow concurrent reads and writes across multiple threads and SSDs, optimizing hardware utilization.

1.8 Archivers

Archivers distribute the storage of blockchain data across many nodes using Proof of Replication (PoRep), ensuring decentralization and security without requiring high hardware specifications.

2. Growth Catalysts

2.1 User Adoption and dApp Ecosystem

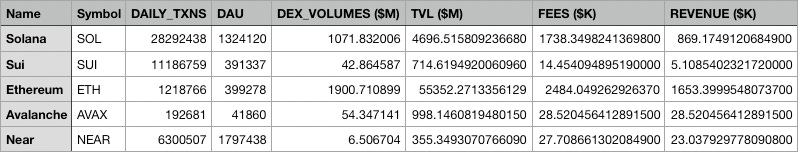

Solana leads in daily transactions, supported by 1.3 million daily active addresses, only trailing Tron and Near. Its decentralized exchange (DEX) volume is at $1.071 billion, with a total value locked (TVL) of $4.6 billion, mainly behind Ethereum(for both), TRON(for TVL), and BSC/BNB(for TVL). Solana’s robust ecosystem includes 139 protocols (behind 8 major EVM chains as per DefiLlama) and substantial on-chain stable-coin market capitalization(only behind ETH, TRON, BSC/BNB), positioning it as a leading blockchain.

2.2 Partnerships and Integrations

Solana has secured critical partnerships with Stripe, Visa, Shopify, and Google Cloud, enhancing its blockchain's utility and fostering wider adoption. These collaborations enable various real-world applications, from payment processing to web3 gaming, promoting Solana’s integration into mainstream commerce.

2.3 Saga(Solana) Phone

The Saga phone, equipped with a crypto wallet and a dApp store, sold 60,000 units, challenging conventional app marketplaces. This initiative boosts Solana's network by appealing to a mobile-first audience and supports decentralized app distribution.

2.4 DePIN, Memes & NFTs

As projects such as Helium (a decentralized telecommunications provider), Hive Mapper, Teleport (a decentralized ride-sharing service), IoNET, and Render(a DeREN) continue to grow and attract users, they are poised to significantly boost activity on the Solana network.

Solana is prominent chain for memecoin trading, hosting three (WIF, BONK {with 729,000 wallets holding it and a strong community}, BOME) meme coins among the top 100 by market cap. Its NFT standard, Metaplex, has facilitated over 340 million mints, with leading collections generating substantial trading volumes, demonstrating its competitive transaction fees and fast transaction processing speed.

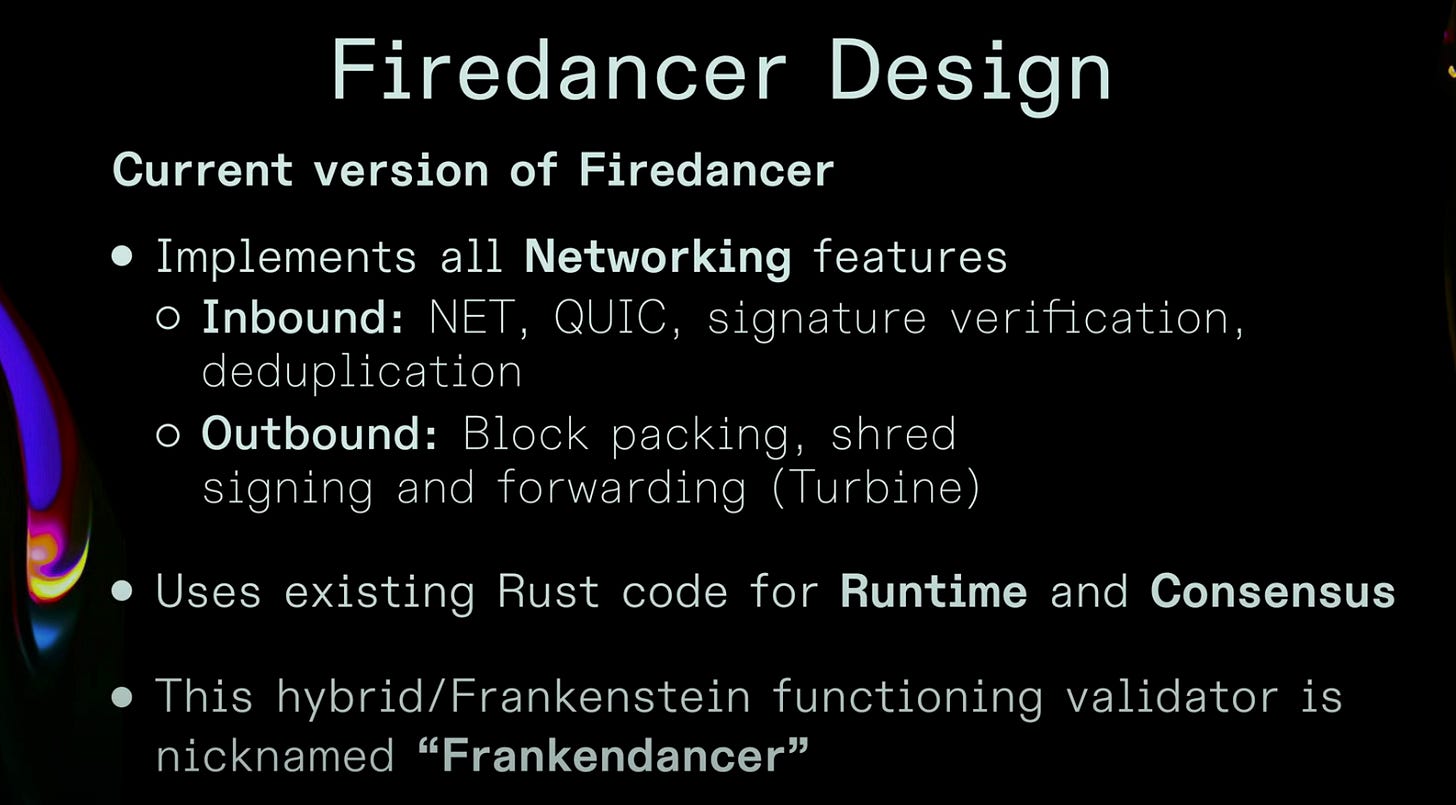

2.5 Validator Client Diversity & Firedancer

Firedancer, developed by Jump Trading, enhances Solana's network performance, supporting over 1 million transactions per second per CPU core. Rewriting the inbound/outbound networking implementation which were the bottleneck of Rust library being used. The presence of multiple validator clients like Anza and Tiny Dancer increases network resilience and diversification.

2.6 Wallets & Solana(Chain) being the publisher

Solana has two key wallets, Phantom and Backpack, with Phantom holding the lion's share of the market. Currently, Phantom boasts 3 million users on Chrome(web store), while Backpack has 300,000; this is in contrast to Metamask's 17 million users and 1 million downloads on the Play Store for Phantom. The landscape may shift significantly with the rise of Saga phones, potentially positioning a wallet like Phantom to bridge the 'super app' gap prevalent in the West.

We are witnessing a transition in the digital currency landscape, moving from an era where exchanges acted as the primary gatekeepers. Previously, a project had to be listed on a tier-1 exchange to gain legitimacy, often at the expense of the project's own interests. The new phase is more decentralized, with blockchains serving as the primary platforms for launching projects. Initially, these projects may start with a low Fully Diluted Valuation (FDV), but if they achieve product-market fit, they are likely to grow quickly and sustain value through subsequent cycles. Examples of such projects that launched tokens in the past six months are Jito, Jupiter, Tensor, Kamino, Drift.

3. Associated Risks

Network Reliability Concerns: Solana has faced several significant outages, such as the February 6, 2024, incident caused by an infinite loop error, raising doubts about its reliability. These outages highlight vulnerabilities from software bugs affecting user trust. Along with the bug in QUIC’s implementation that was patched quickly in mid April, 2024.

Security and Client Diversity: The current reliance on a single major validator client exposes Solana to risks of central failure. Developing a second validator client is crucial to enhance security and network resilience.

Technical Debt: Solana's swift development trajectory has introduced technical complexities, particularly with modifications to Rust and LLVM to optimize performance and add unique features. These changes, although enhancing system performance, complicate maintenance and require continuous efforts to integrate the latest security updates and improvements from the main Rust and LLVM branches. Maintaining these customized versions adds a substantial ongoing challenge.

Competitive Threats: The rise of alternative platforms such as Sui presents a formidable competitive risk to Solana. With a network that has 100% uptime in its first year of operation, Sui positions itself as a main competitor to Solana. Also, its Move programming language and object-oriented approach offer a flexible and secure environment for developers.

Dapps Moving to their own L2’s: During the most recent network performance degradation the founder of Drip was debating(/considering) launching their own L2 on Solana. There is other teams like Zeta Markets and Grass (Get Grass) that are building L2’s on Solana.

Jito’s Mempool shutdown because of MEV: Miner(/Maximal) Extractable Value (MEV) issues, particularly sandwich attacks that exploit users, have raised concerns within Solana’s ecosystem. The shutdown of Jito’s mempool to prevent such exploits, while beneficial in reducing user costs, presents both technical and social challenges. The community's unpreparedness and lack of proactive user protection measures, such as educating on slippage and improving liquidity and wallet integrations, underscore a critical oversight. Jito's efforts to build MEV defenses transparently and in good faith point to a broader failure to collaboratively address and mitigate exploitative practices. This situation exposes Solana to potential disruptions, emphasizing the need for a more unified approach to tackling MEV and enhancing overall network resilience and fairness.

4. Solana's Token Design

Token Utility and Economics

The SOL token is integral to the Solana network, enabling transaction processing, and network security through staking. Users pay transaction fees in SOL, which not only facilitates operations but also incentivizes validators. By staking SOL, users participate in the network's Proof-of-Stake (PoS) consensus mechanism, helping secure the blockchain and earning rewards.

Tokenomics and Supply Dynamics: Initially, Solana had 500 million SOL tokens, with an inflation rate starting at 8% and designed to decrease by 15% annually until it stabilizes at 1.5%. This model aims to balance incentivization with economic stability, gradually reducing new token issuance to control inflation while maintaining network security. The supply of SOL is expected to reach 700m tokens by Jan 2030.

Burn Mechanism: To counteract inflation, Solana burns 50% of all transaction fees (with other 50% going to the validators), permanently removing them from circulation, which supports the token’s long-term value and scarcity.

Token Functions: Compute and Rent

Compute Payments: Users of the Solana network pay for the computational resources required to execute programs(/smart contracts) on-chain. These payments are made in SOL and are based on the compute units consumed during execution.

Rent Mechanism: Solana requires users to pay rent in SOL for creating accounts on the network. This rent is determined based on the amount of data stored.

5. Future Prospects for the Next 1-2 Years

Price Projections

Looking ahead to the next 1-2 years for Solana, we can derive insights from historical cryptocurrency market cycles. In December 2017, Bitcoin (BTC) reached a market cap of $278 billion and Ethereum (ETH) was at $123 billion. Fast forward to November 2021, BTC topped at $1.22 trillion and ETH at $547 billion. Assuming a continuation of these trends and projecting BTC peak to be between $120K - $140K, we might see BTC achieving a market cap of approximately $2.561 trillion (assuming a price of $130K multiplied by 19.7 million BTC in circulation). Correspondingly, based on previous ratios, ETH could reach a market cap of around $1.28 trillion.

Applying similar logic to Solana, which previously reached a market cap approximately 7.29 times lower than ETH's peak market cap, we could forecast Solana’s market cap at around $175 billion. This scenario would price Solana (SOL) at approximately $391, assuming market conditions and ratios akin to previous cycles.

Technical Updates / Improvements

Significant technological advancements are on the horizon for Solana. Noteworthy is the anticipated mainnet launch of Firedancer. Anatoly, in a recent podcast, mentioned experimenting with reducing block times from the current 400ms, aiming to boost network performance. Moreover, the introduction of Program Runtime v2 will crucially enhance Solana by increasing execution speed and efficiency through advancements in Cross-Program Invocation and account reallocation. This upgrade is expected to significantly improve transaction throughput and smart contract capabilities. Furthermore, the SPL token standard (similar to Ethereum's ERC20 standard) and Metaplex are now mature enough to meet enterprise use cases.

References & Further Deep Dive:

Anatoly GPT to know more about the internals of the validator codebase

Turbine Block Propagation Solana Labs Docs

Turbine Block Propagation medium blog

Solana Pay Shopify Partnership

Goole Cloud Solana Partnership

Google Cloud BigQuery integration with Solana for indexing/analytics

Mert's thoughts on MEV and JITO shutting down its mempool

Web3 Builders Alliance course notes for details about compute units and rent mechanism in Solana

Tail at Scale Jeff Dean - Reliability/Latency

Compute Units consumed per block by different Dapps

Birdeye dot SO Bonk Technicals

Artemis Chain data for the table in section 2.1

Helius Blog on Evaluating Solana for Enterprise Use

Frictionless Capital's Diego's (Solana Legends) Solana Blog

Van Ecks Digital Assets Teams Solana Valuation

Note: None of this is financial advice!